working capital funding gap calculation

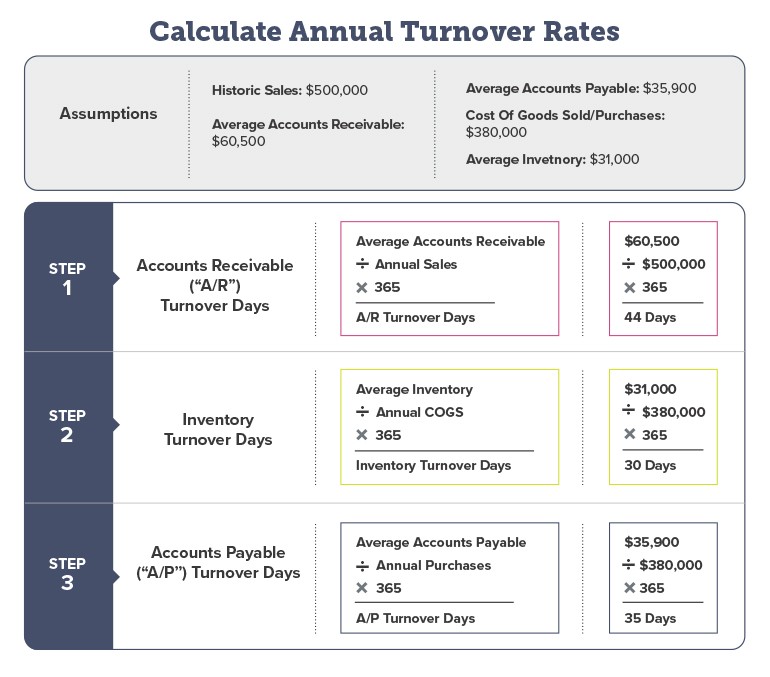

Link between the internal company documents in 3a and the data reported in the excel template. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999.

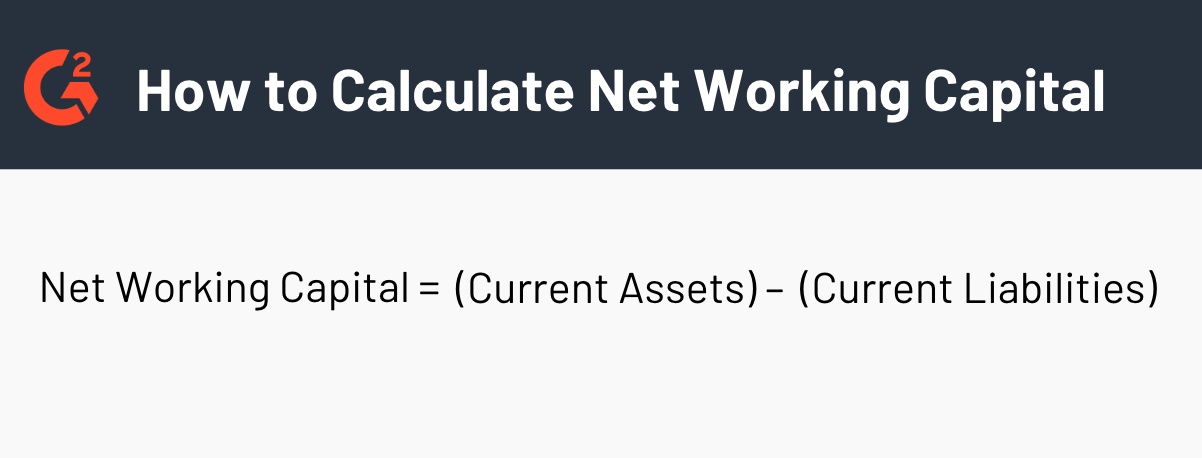

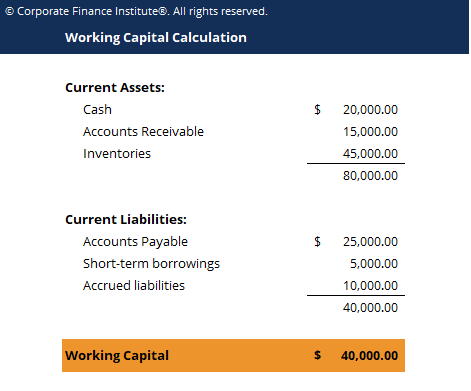

Accounts payable liability With what we know from before we would then get the following simplified formula as definition of Working Capital.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

. Working capital refers to the assets. WACC used to calculate the funding gap. Ad National Funding Working Capital Loans.

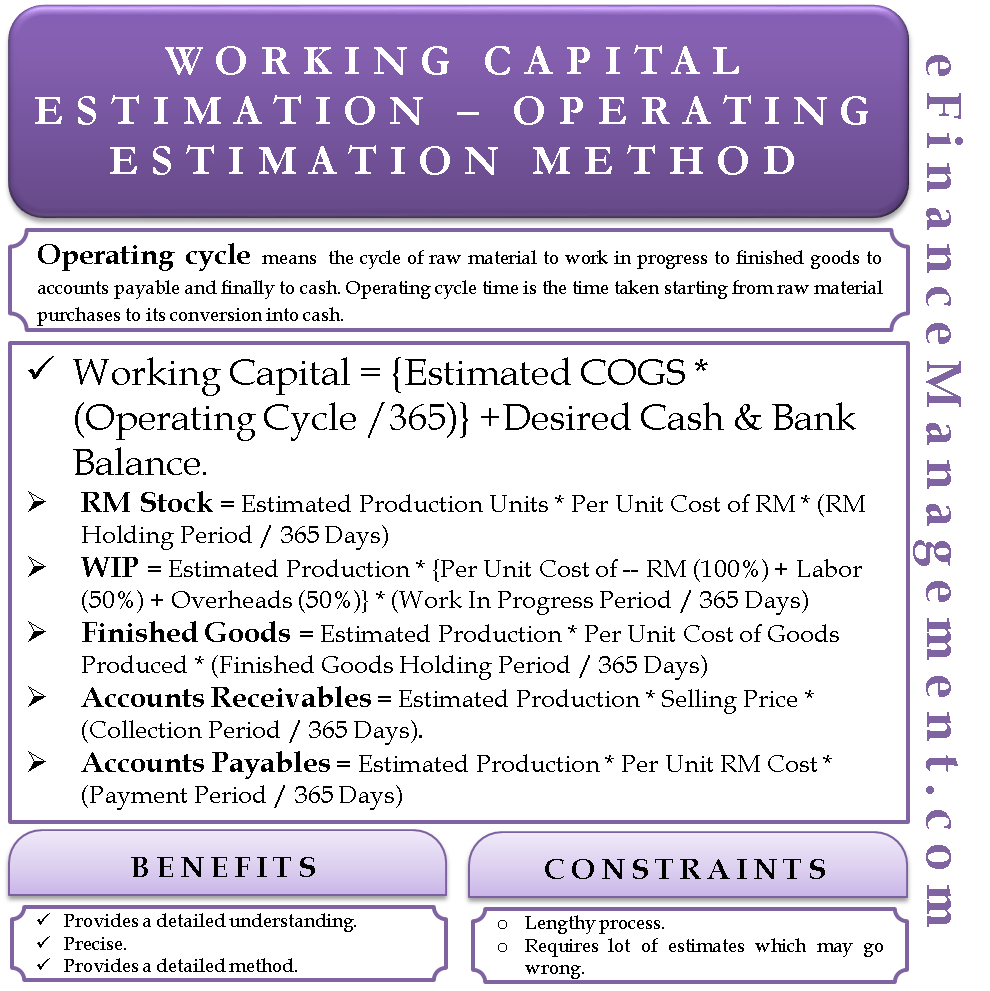

Days working capital is an accounting and finance term used to describe how many days it takes for a company to convert its working capital into revenue. The Working Capital Requirement WCR is a financial metric showing the amount of financial resources needed to cover the costs of the production cycle upcoming. Go to the LendingTree Official Site Get Offers.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Ad Get Working Capital Funding Fast. Compare up to 5 Loans Without a Hard Credit Pull.

Published on January 7 2017 January 7 2017 3 Likes 0 Comments. With annual sales of 32 billion it generated average. Equation for calculate funding gap is Funding Gap Adequacy Goal - Current Spending.

The calculation includes recievables days inventory days. Ad Get Working Capital Funding Fast. The working capital calculator is an easy-to-use online tool that allows businesses to determine how much surplus cash they need to keep running.

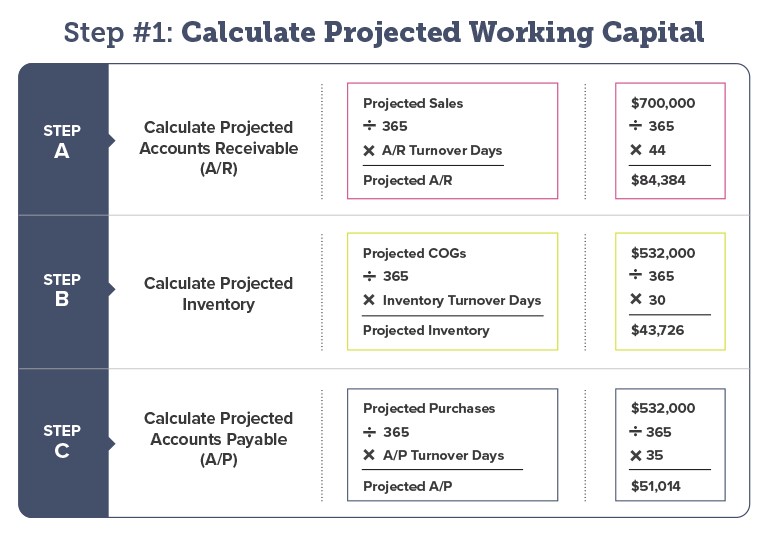

Changes in net working capital line 100 of tab Funding gap if any. To calculate the working capital needs one needs to use the following. Accounts receivable inventory.

A more useful tool for determining your working capital needs is the operating cycle. Compare up to 5 Loans Without a Hard Credit Pull. The Committees now finalised Basel III reforms complement these improvements to the global.

The company must elaborate on how to. The operating cycle analyzes the accounts receivable inventory and accounts. Product lifecycle from its launch to the projected last year of sales.

Working capital funding gap calculation Friday June 3 2022 Edit. Working Capital How to calculate and fill cash flow gap. Working Capital How to calculate and fill cash flow gap.

The working capital cycle measures how efficiently a business is able to convert its working capital into revenue. And generally speaking the CFO CEO and investors will want the business to operate with. It can be seen from the above calculation that providing the sales remain constant then the level of working capital financing will remain constant.

Taxes line 99 of tab Funding gap. It can be used. Working capital is a key indicator of the financial health of a company.

Go to the LendingTree Official Site Get Offers.

Days Working Capital Formula Calculate Example Investor S Analysis

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Cycle What Is It With Calculation

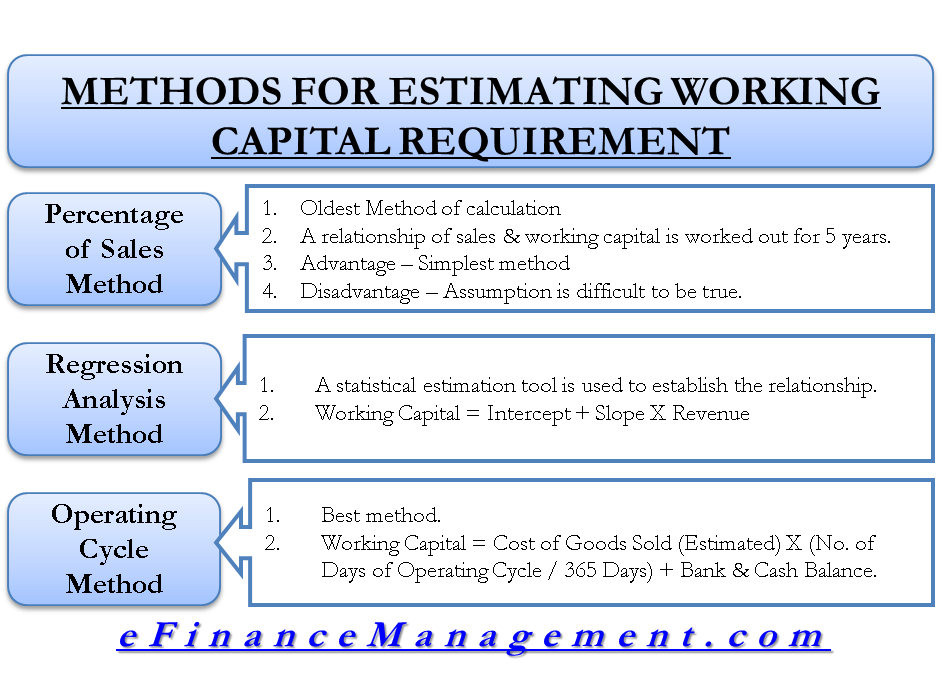

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Working Capital Financial Edge Training

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula Youtube

Working Capital What Is Working Capital Youtube

Working Capital Cycle Definition How To Calculate

Working Capital Estimation Operating Cycle Method

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Template Download Free Excel Template

Methods For Estimating Working Capital Requirement

Working Capital Cycle Efinancemanagement

How Much Working Capital Is Needed To Grow Your Business Pursuit

Capital Employed Accounting And Finance Financial Management Shopify Business

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)